Thinking of buying a new car? Not sure where to start? Don’t worry, we’ve got you covered. In this article, we’ll provide you with all the information you need to make an informed decision about your next car purchase.

Editor’s Note: Our “Tips on Buying a New Car” guide has been updated for 2023. We’ve included the latest information on car prices, financing options, and more.

We’ve done the research and put together this comprehensive guide to help you make the right decision. So whether you’re a first-time car buyer or you’re just looking for an upgrade, read on for our top tips.

Key Differences:

| New Car | Used Car | |

|---|---|---|

| Price | More expensive | Less expensive |

| Reliability | More reliable | Less reliable |

| Features | More features | Fewer features |

Main Article Topics:

- How to Determine Your Needs

- How to Research Your Options

- How to Get the Best Price

- How to Finance Your Car

- How to Maintain Your Car

Tips on Buying a New Car

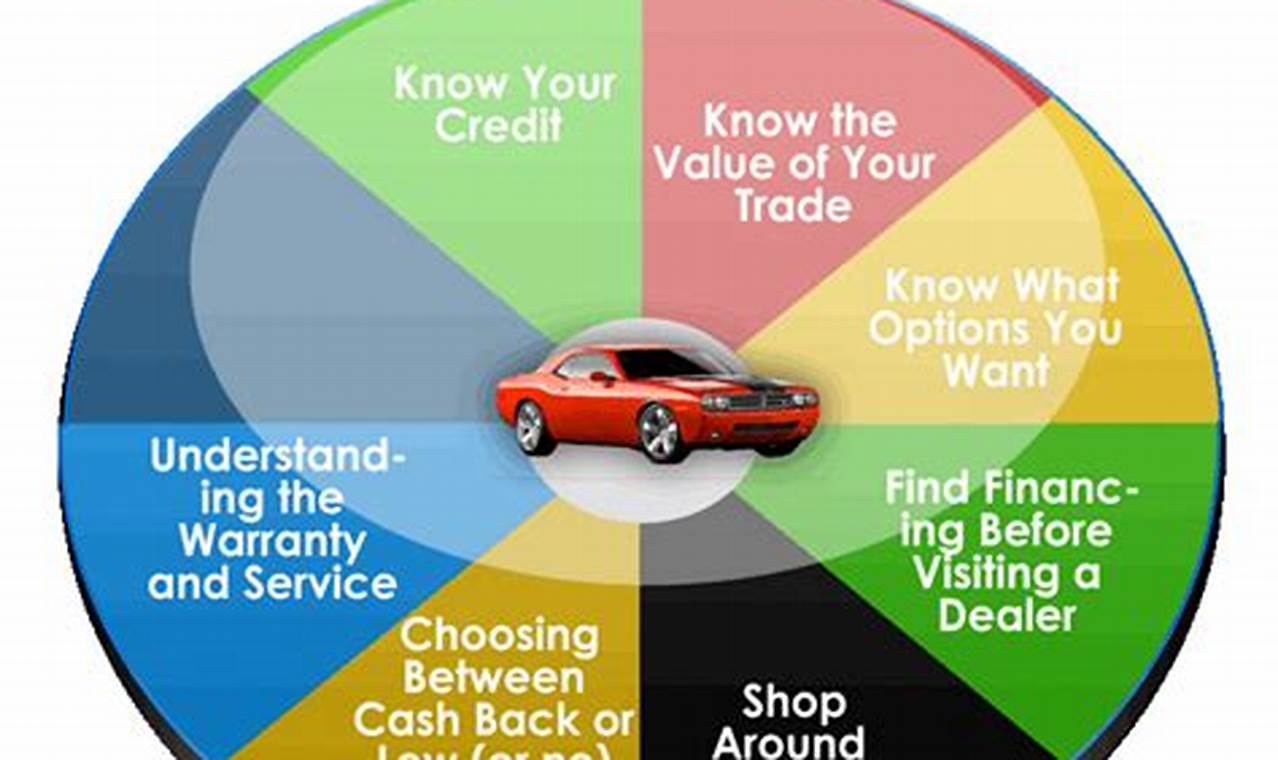

Buying a new car is a major purchase, so it’s important to do your research and make sure you’re getting the best possible deal. Here are eight key aspects to consider:

- Budget: Determine how much you can afford to spend on a new car, including the purchase price, interest on a loan, insurance, and maintenance costs.

- Needs: Consider your lifestyle and needs when choosing a new car. Do you need a large SUV for a growing family, or a fuel-efficient sedan for commuting?

- Research: Research different makes and models of cars to find one that meets your needs and budget. Read reviews, compare prices, and talk to other car owners.

- Negotiate: Don’t be afraid to negotiate with the dealer on the price of the car. Be prepared to walk away if you don’t get a fair deal.

- Financing: If you need to finance your car, shop around for the best interest rates and loan terms.

- Insurance: Make sure you have adequate insurance coverage for your new car before you drive it off the lot.

- Maintenance: Follow the manufacturer’s recommended maintenance schedule to keep your car in good condition.

- Safety: Choose a car with good safety ratings and features, such as airbags, anti-lock brakes, and electronic stability control.

By considering these key aspects, you can make an informed decision about buying a new car that meets your needs and budget. Remember to do your research, compare prices, and negotiate with the dealer to get the best possible deal.

Budget

When it comes to buying a new car, setting a budget is crucial. It helps you stay within your financial means and make an informed decision about your purchase. Here are a few key aspects to consider when determining your budget:

- Purchase Price: This is the upfront cost of the car itself. It’s important to factor in any taxes, fees, or other charges that may be associated with the purchase.

- Interest on a Loan: If you’re financing your car, you’ll need to factor in the interest you’ll pay on the loan. The interest rate will vary depending on your credit score and the terms of the loan.

- Insurance: Car insurance is required by law in most states. The cost of insurance will vary depending on your driving history, the type of car you drive, and the amount of coverage you choose.

- Maintenance Costs: Even new cars require regular maintenance, such as oil changes, tire rotations, and brake inspections. It’s important to factor in the cost of these services when setting your budget.

Once you’ve considered all of these factors, you can set a realistic budget for your new car. Remember, it’s important to stick to your budget and avoid overspending. Buying a new car should be an enjoyable experience, but it’s also a major financial decision. By following these tips, you can make an informed decision and get the best possible deal on your new car.

Needs

When it comes to buying a new car, one of the most important factors to consider is your lifestyle and needs. Your car should be able to accommodate your daily activities and provide a comfortable and safe driving experience. Here are a few key questions to ask yourself when determining your needs:

- How many people do you need to transport regularly? If you have a large family, you’ll need a car with plenty of seating and cargo space. A minivan or SUV would be a good option.

- What type of driving do you do most often? If you mostly drive in the city, a fuel-efficient sedan or hatchback would be a good choice. If you frequently drive on highways or in rural areas, you may want a car with more power and better handling, such as an SUV or crossover.

- What are your hobbies and interests? If you enjoy outdoor activities, you may want a car with all-wheel drive or four-wheel drive. If you’re a music lover, you may want a car with a premium sound system.

Once you’ve considered your lifestyle and needs, you can start to narrow down your choices. It’s important to do your research and compare different makes and models of cars to find one that meets your specific requirements. By following these tips, you can choose a new car that will fit your lifestyle and provide years of enjoyment.

Research

Research is a crucial component of “tips on buying new car” as it empowers consumers to make informed decisions that align with their specific requirements and financial capabilities. By thoroughly researching different makes and models of cars, individuals can identify vehicles that possess the desired features, performance, and safety ratings while staying within their budget.

The process of reading reviews from reputable sources, comparing prices across dealerships, and engaging in conversations with current owners provides valuable insights into the real-world experiences and opinions of others. This information can uncover potential issues or highlight hidden gems that may not be readily apparent from manufacturer specifications alone.

Understanding the connection between “Research: Research different makes and models of cars to find one that meets your needs and budget. Read reviews, compare prices, and talk to other car owners.” and “tips on buying new car” is essential for consumers seeking to navigate the complex and often overwhelming car buying process. By dedicating time and effort to research, individuals can increase their chances of selecting a vehicle that meets their unique needs and provides a satisfying ownership experience.

Key Insights:

| Research Aspect | Importance |

|---|---|

| Reading Reviews | Provides firsthand accounts of vehicle performance, reliability, and ownership costs. |

| Comparing Prices | Ensures consumers secure the best possible deal and avoid overpaying. |

| Talking to Other Car Owners | Reveals practical insights and experiences that may not be available through other research methods. |

Negotiate

Negotiation is a crucial aspect of “tips on buying new car” as it empowers consumers to secure a favorable price that aligns with their budget and expectations. By engaging in effective negotiation strategies, individuals can potentially save thousands of dollars on the purchase of their new car.

- Understanding Market Value: Before entering negotiations, research the fair market value of the car you’re interested in. This can be done through online resources, such as Kelley Blue Book or NADA Guides. Knowing the car’s value gives you a strong starting point for negotiations.

- Be Prepared to Walk Away: One of the most important negotiation tactics is being prepared to walk away from the deal if you don’t get a fair offer. This demonstrates to the dealer that you’re serious about getting a good price and that you’re not willing to overpay.

- Negotiate Multiple Aspects: Don’t just focus on the sticker price of the car. There are other aspects that you can negotiate, such as the trade-in value of your old car, the interest rate on your loan, and any additional fees or add-ons.

- Get Everything in Writing: Once you’ve reached an agreement with the dealer, make sure to get everything in writing. This will protect you in the event of any disputes down the road.

By following these negotiation tips, consumers can increase their chances of getting a fair deal on their new car. Remember, negotiation is a skill that can be learned and improved through practice. The more you negotiate, the more confident and successful you’ll become.

Financing

Financing is a critical component of “tips on buying new car” as it enables consumers to spread the cost of their purchase over time. By securing favorable financing terms, individuals can reduce their monthly payments and potentially save thousands of dollars over the life of their loan.

The process of shopping around for the best interest rates and loan terms involves comparing offers from multiple lenders, such as banks, credit unions, and online lenders. Each lender will have its own set of criteria for approving loans and determining interest rates. It’s important to compare the annual percentage rate (APR) of each loan offer, which represents the true cost of borrowing. A lower APR means lower monthly payments and less interest paid over time.

In addition to interest rates, consumers should also consider the loan term, which is the length of time over which the loan will be repaid. A longer loan term will result in lower monthly payments but higher total interest paid. Conversely, a shorter loan term will result in higher monthly payments but lower total interest paid.

By carefully considering their financing options and shopping around for the best rates and terms, consumers can secure a financing plan that meets their budget and financial goals. This will allow them to drive away in their new car with confidence, knowing that they have obtained the most favorable financing terms available.

Key Insights:

| Financing Aspect | Importance |

|---|---|

| Comparing Interest Rates | Securing the lowest possible interest rate reduces monthly payments and saves money over the life of the loan. |

| Considering Loan Term | Choosing an appropriate loan term balances monthly affordability with total interest paid. |

| Shopping Around | Comparing offers from multiple lenders ensures consumers secure the most competitive financing terms. |

Insurance

Adequate insurance coverage is an indispensable component of “tips on buying new car” as it safeguards consumers against financial liabilities and risks associated with owning and operating a vehicle. By securing comprehensive insurance, individuals can protect themselves and their new car from unforeseen events, ensuring peace of mind and financial security.

Driving without proper insurance is not only illegal in most jurisdictions but also exposes individuals to substantial financial risks. In the event of an accident, uninsured drivers may be held personally liable for damages caused to other vehicles, property, and individuals. This can result in significant financial burdens, including expensive legal fees, medical bills, and repair costs.

Comprehensive insurance coverage typically includes liability insurance, which protects against damages caused to others, as well as collision and comprehensive coverage, which protects against damages to the insured vehicle itself. It’s important to carefully review the terms and conditions of an insurance policy to ensure that it provides adequate coverage for the specific needs and risks associated with the new car.

Obtaining adequate insurance coverage is not merely a legal obligation but a wise financial decision that provides peace of mind and protects consumers from unforeseen circumstances. By understanding the connection between “Insurance: Make sure you have adequate insurance coverage for your new car before you drive it off the lot.” and “tips on buying new car,” individuals can make informed decisions and safeguard their financial well-being while enjoying the benefits of their new car.

Key Insights:

| Insurance Aspect | Importance |

|---|---|

| Legal Requirement | Driving without insurance is illegal and can result in penalties. |

| Financial Protection | Insurance coverage protects against financial liabilities in the event of an accident. |

| Peace of Mind | Adequate insurance provides peace of mind and reduces financial stress. |

Maintenance

Regular maintenance is a crucial component of “tips on buying new car” as it plays a pivotal role in preserving the performance, safety, and longevity of a vehicle. By adhering to the manufacturer’s recommended maintenance schedule, individuals can proactively address potential issues, prevent costly repairs, and extend the lifespan of their new car.

Neglecting maintenance can have severe consequences. Without regular oil changes, engines can suffer from lubrication problems, leading to premature wear and tear. Similarly, failing to rotate tires can result in uneven tread wear and reduced handling performance. Ignoring brake inspections and fluid changes can compromise braking efficiency and pose safety risks.

Following the manufacturer’s maintenance schedule ensures that all essential components of the car are inspected and serviced at the appropriate intervals. This includes regular oil changes, tire rotations, brake inspections, fluid changes, and filter replacements. By proactively addressing potential issues, individuals can prevent minor problems from escalating into major and expensive repairs.

Furthermore, maintaining a well-serviced car can enhance its resale value. A vehicle with a documented maintenance history is more attractive to potential buyers and commands a higher price compared to a neglected car.

Key Insights:

| Maintenance Aspect | Importance |

|---|---|

| Regular Inspections | Identify and address potential issues early on, preventing costly repairs. |

| Scheduled Servicing | Ensure optimal performance, safety, and longevity of the vehicle. |

| Documented History | Enhance resale value and provide peace of mind to potential buyers. |

Safety

Prioritizing safety is an integral aspect of “tips on buying new car” as it directly impacts the well-being of drivers and passengers. Selecting a car with good safety ratings and advanced safety features can significantly reduce the risk of injuries or fatalities in the event of a collision.

Crash test ratings conducted by independent organizations, such as the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS), provide valuable insights into a vehicle’s ability to withstand impacts and protect occupants. These ratings are based on rigorous testing procedures that simulate real-world crash scenarios.

Key safety features to consider include airbags, which inflate rapidly to provide cushioning and restrain occupants; anti-lock brakes (ABS), which prevent wheels from locking during braking, allowing for better control and stability; and electronic stability control (ESC), which helps prevent skidding and loss of control by automatically adjusting braking and engine power.

Investing in a car with a high safety rating and advanced safety features not only enhances peace of mind but also potentially lowers insurance premiums. Insurance companies often offer discounts to drivers who own vehicles with good safety records.

Key Insights:

| Safety Aspect | Importance |

|---|---|

| Crash Test Ratings | Provide objective evaluations of a vehicle’s ability to withstand impacts and protect occupants. |

| Safety Features | Airbags, ABS, and ESC enhance occupant protection and reduce the risk of injuries. |

| Insurance Benefits | Cars with good safety ratings may qualify for insurance discounts. |

Frequently Asked Questions about Buying a New Car

Buying a new car is a significant purchase that raises many questions. Here are answers to some of the most frequently asked questions to help you make an informed decision:

Question 1: How much can I afford to spend on a new car?

Answer: Determine your budget by considering the purchase price, interest on a loan (if applicable), insurance, and ongoing maintenance costs.

Question 2: What type of car is right for me?

Answer: Evaluate your lifestyle and needs to identify the appropriate size, body style, and features that align with your daily driving requirements.

Question 3: How do I find the best deal on a new car?

Answer: Research different makes and models, compare prices from multiple dealerships, and negotiate to secure favorable terms.

Question 4: What financing options are available?

Answer: Explore various financing options, such as bank loans, credit unions, and manufacturer incentives, to find the most suitable interest rates and loan terms.

Question 5: How can I ensure my new car is safe?

Answer: Prioritize safety by choosing a car with high crash test ratings and advanced safety features, including airbags, anti-lock brakes, and electronic stability control.

Question 6: How do I maintain my new car properly?

Answer: Follow the manufacturer’s recommended maintenance schedule for regular inspections, oil changes, tire rotations, and other services to keep your car in optimal condition.

Summary: Buying a new car involves careful planning and informed decision-making. By addressing these frequently asked questions, you can navigate the process confidently and choose a car that meets your needs, fits your budget, and provides peace of mind.

Next Article Section: Tips for Negotiating the Best Price on a New Car

Tips on Buying a New Car

Purchasing a new car is a significant financial decision that requires careful planning and informed choices. Here are some essential tips to guide you through the process:

Tip 1: Establish a Realistic Budget: Determine your financial limits, considering the purchase price, loan interest (if applicable), insurance costs, and ongoing maintenance expenses.

Tip 2: Identify Your Needs: Evaluate your lifestyle and driving requirements to select a car that aligns with your daily commute, passenger capacity, and cargo space needs.

Tip 3: Research and Compare: Explore different makes and models, read reviews, and compare specifications to identify vehicles that meet your requirements and budget.

Tip 4: Negotiate Effectively: Engage in negotiations with dealerships to secure a favorable price. Be prepared to discuss trade-in value, financing terms, and any additional fees.

Tip 5: Secure Adequate Financing: Explore financing options from banks, credit unions, or manufacturers to find competitive interest rates and loan terms that align with your financial situation.

Tip 6: Prioritize Safety: Choose a car with high safety ratings and advanced safety features, such as airbags, anti-lock brakes, and electronic stability control, for optimal occupant protection.

Tip 7: Follow Manufacturer’s Maintenance Schedule: Adhere to the recommended maintenance schedule provided by the manufacturer to ensure optimal performance and longevity of your vehicle.

Tip 8: Consider Resale Value: When selecting a car, consider its potential resale value to minimize depreciation and maximize your investment.

Summary: By following these tips, you can make an informed decision when purchasing a new car. Careful planning, research, and negotiation will enable you to choose a vehicle that meets your needs, fits your budget, and provides a safe and enjoyable driving experience.

Conclusion

The decision to purchase a new car requires careful consideration and informed choices. By following the tips outlined in this article, individuals can navigate the process confidently and make a well-rounded decision that aligns with their needs, budget, and lifestyle.

Remember to establish a realistic budget, identify your requirements, research and compare different vehicles, negotiate effectively, secure adequate financing, prioritize safety, follow recommended maintenance schedules, and consider resale value. These key aspects will empower you to choose a car that not only meets your immediate transportation needs but also provides long-term satisfaction and value.

Youtube Video: